In Search of Solutions to the Housing Crisis

- vicluca

- Jan 26, 2021

- 6 min read

Updated: Mar 10, 2021

Victor Luca, 27-Jan-21.

The present explosion in house-price inflation is a boon for some and an absolute catastrophe for others.

Yet this astronomical increase in the price of housing in NZ did not happen overnight but rather prices started to escalate dramatically and exponentially after about 1990 (Figure 1). I hate to be repetitive but since ‘a picture’s worth a thousand words’ this is one that is seared onto my brain and that I think captures the moment.

Figure 1. Stand-alone house prices and average hourly wages for the period 1963-2015. Sources: RBNZ HPI RD from Key Graphs Housing Data; SNZ. Inforshare series EMP013AA, QU009AA, QEX002AA linked; CPI

The graph of Figure 1 shows that as wages have remained relatively flat, house prices have soared, undergoing a marked exponential acceleration starting from the early nineties.

The natural questions to ask are what are the drivers and who is to blame? Let’s start by asking what color of government has presided over this period of escalation? If we take a look at when significant escalation commenced we see that it was just after the copy-cat neoliberal ‘Rogernomic’ reforms of the 4th Labor government that house prices started to take off. The policies were then continued under National and Labor in an alternating fashion. So you would have to conclude that they are both to blame!

As this catastrophe unfolds for about one third of the population there has been much commentary from experts and dilettantes alike regarding causes and fixes. The causes of house price inflation that are most often mentioned include:

1) Shortage of supply - itself a symptom of demand growth due to population growth and foreign buyers.

2) Lack of land availability. A responsibility of territorial authorities (TA).

3) RMA and building regulations. Again something for which TA are responsible.

4) Monetary policy as determined by government, the RBNZ and commercial banks.

Whilst all of the above factors influence prices to different degrees, in previous writings on this subject I have given considerable weight to monetary policy. Monetary policy rests squarely at the feet of present and past Governments and the RBNZ in that order. The direct correlation between the house price index over time and the increase in the money supply implicates this as a major factor and in my piece in The Beacon and on my blog I have highlighted this (Housing Crisis – Causes, Aug 11, 2020).

I would suggest that Government and everyone else read the RBNZ Act of 1989 where in section 169 it clearly states that “It shall be an objective of the Bank to exhibit a sense of social responsibility in exercising its powers under this Act”. So far the only objectives that I ever see and hear mentioned in major media are financial stability and employment.

How may I ask is the RBNZ fulfilling the social objective by allowing house prices to escalate as they are?

Isn’t it time that both Government and the RBNZ took their responsibilities seriously and took control of the financial system rather than hope that printing money is going to solve the problem instead of exacerbating it? If the market has not worked in four decades, then isn't it naïve to think that it is going to work now? Government has a duty of care to all New Zealanders, not just the wealth.

After a quiet spell over the festive season the Government has finally come out with what they think is going to be part of a solution to the unfolding housing catastrophe. And low and behold the first move involves supply-side intervention in the form of building more houses, something in which they haven’t so far had a good track record.

And their definition of what constitutes 'affordable' housing is simply a joke. Government’s recently stated objectives are to build about 8,000 dwellings by the end of 2024. That represents about 2,500 houses per year.

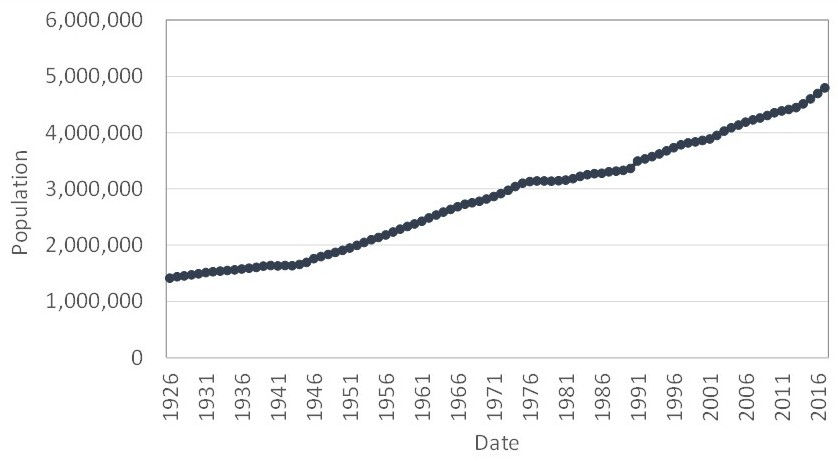

So let’s delve a bit deeper into how it is that population increase fuels the demand side of the equation. In Figure 2, I show a graph of the New Zealand population as a function of time. Since about 2015 NZ has been adding about 100,000 new citizens per year and this represents a population increase of about 2%. If this annual growth rate continues then NZ’s population will double in 35 years. You only need high school math to get to this number.

Figure 2. New Zealand population over time.

Now let’s take a look at New Zealand’s net migration rate (Figure 3).

Over the years 2014 to 2017 (National Government) the net migration rate increased almost linearly. It then dropped slightly in 2018 before resuming its upward march in 2019. We know what happened in 2020. The data show that despite the COVID-19 pandemic, we added about 45,000 more migrants in 2020. Recent reporting indicates that of these new entrants about 11,200 are returning permanent residents. I don't know what the remainder are.

Figure 3. Net migration between 2014 and 2020. Net migration is the difference between immigration into and emigration from the country during the year.

In NZ the average number of people in a household is about 2.7, so dividing 45,000 by 2.7 would indicate that we will need to build at least 17,000 homes per year to house these new entrants. If the government builds 2,500 per year as promised then that would be only fraction of the homes needed. Now our migration rate accounts for about 75% of our 2% annual population increase, the remainder comes from natural reproduction. So we will need approximately 21,500 new homes per year if we continue to add people.

Clearly, keeping the foot on the migration accelerator is only going to exacerbate housing and other problems. New migrants probably bring their own resources to either buy existing homes or build new homes to fulfill their needs. In either case they put upward pressure on existing house prices as well as land and building costs. It is obvious that as long as high rates of migration are maintained government and private sectors will never be able to satisfy demand. They clearly haven't done so thus far.

Aside from the impact of high house prices on present and future generations, high migration rates also require the provision of infrastructure. New infrastructure such as electricity, roading, water and waste management takes time to build even if new migrants are paying taxes. It is not surprising that territorial authorities are struggling in this area also. Provision of infrastructure will be challenging enough as a result of climate change mitigation and adaption. But the culprits are those with their foot on the migration accelerator. And guess who that is?

So Jacinda is right in saying that building more houses is only one part of the solution to putting downward pressure on house prices. She is right to say that, "There are a number of levers and we have continued to do work on both demand-side and supply-side." The Government in fact has all the levers and it is clear that they just haven't figured out how to use them.

The Labour Government instituted a foreign buyer ban in 2019 but clearly this has not been sufficient to quell demand.

Now let’s come back to what I consider to be perhaps the major factor in determining prices, monetary policy and the role of Government and the RBNZ, something that only they can fix it.

Unfortunately, these folk are locked into an economic paradigm that they don’t seem to know how to get out of. The 'market will fix it' ideology and dogma are ruling the day, and they seem incapable of thinking outside this box. Running up the white flag doesn’t seem to be an option.

I think the answer has to be that government uses its immense balance sheet to provide cheap loans directly to people totally avoiding the commercial banks that in order to reduce their risks tend to lend to those that already have capital. Since it is Government’s job to take care of the 'common good' surely they can be more equitable in their lending policies. That is, they lend to those that need it. This is how the Advance Loans of the sixties worked. In those days housing was about putting a roof over people’s heads rather than speculative investing.

The system as it is, is tantamount to government complicity in facilitating a national housing Ponzi scheme. Perhaps this is being done to boost GDP, and if so, this would come with an incalculable social cost.

I remind readers of the RBNZ’s social responsibilities as stated above. For them to deliver on those social obligations they need to give people a chance to be able to house themselves.

Now for a sporting metaphor. In soccer, hockey, rugby and other team sports, when you hit the wall in terms of forward movement you sometimes need to go backward and regroup in order to go forward more effectively. Perhaps in housing we are at such a juncture.

References

Comments